- #Turbotax advance payments received must be entered professional#

- #Turbotax advance payments received must be entered free#

There are no guarantees that working with an adviser will yield positive returns. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). You need both letters when filing your return as you will enter both amounts to be added to your tax return. All investing involves risk, including loss of principal. This is not an offer to buy or sell any security or interest.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments.

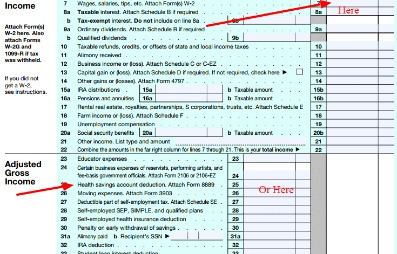

SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Securities and Exchange Commission as an investment adviser. Retirement or pension benefits received from a Michigan or U. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. request that their income tax refund be directly deposited into a U.S. A word of caution to all married parents filing a joint return for tax year 2021 who received advance Child Tax Credit (CTC) payments in 2021: you must combine the total amounts shown in box 1 of both IRS Letters 6419 when you file your federal income tax return this year. You might find that you’d save a significant amount of money one way or another, so it’s best to educate yourself before the tax return deadline. What payment methods does UFile accept UFile currently accepts Visa. Eligible families should receive advance payments, either by direct deposit or check. How do I know when to enter total amounts and when to enter details in my tax file. Normally, the IRS will calculate the payment amount based on your 2020 tax return. If you don’t know whether you’re better off with the standard deduction versus itemizing your deductions, be sure to read up on the two options and do some math. Most families do not need to do anything to get their advance payment.So you should estimate how much you owe and pay it when you file Form 4868. If you owe any taxes for 2022, they are due April 18, 2023. That said, filing Form 4868 will only extend when your tax return is due. If you need more time to do your taxes, you can file for an extension using Form 4868.If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

#Turbotax advance payments received must be entered free#

SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

#Turbotax advance payments received must be entered professional#

0 kommentar(er)

0 kommentar(er)